Golden Handcuffs[Finance Fridays]

The most overlooked part of compensation discussions.

Happy Friday my one and only,

Do you have any groovy plans for this weekend? Let me know in the comments/by replying to this email.

This week’s Finance Friday will discuss the Golden Handcuffs.This is a very important idea when it comes to worker compensation, and understanding it will be crucial for negotiating your own.

Highlights

This post/email will discuss the following ideas-

What are the golden handcuffs- Incentives given to make you stay longer. Often, a certain portion of your compensation is given to you as stocks, vested after a certain period of time.

Why companies offer these arrangements- By giving you stock options, you are more incentivized to work hard. Also, you have to stick around longer. They can also fork out lesser cash to pay you.

Some considerations- Things aren’t always clear cut. Depending on circumstances, getting Stock Options will either benefit or hurt you. It’s important to look over the circumstances.

We will only really be covering the important basics here. I’m not qualified to give you Patrick Boyle or Plain Bagel levels of financial analysis. For that, you should definitely follow their YouTube channels.

Golden Handcuffs 101

Imagine you were joining a company. Since you’re a reader of this award-winning newsletter, the company obviously want to keep you much longer. How can they do that without breaking the bank?

This is where the Golden Handcuffs come in. Golden handcuffs are a collection of financial incentives that are intended to encourage employees to remain with a company for a stipulated period of time. Here is one common way your compensation might be structured-

Base pay of around 200K/year. Salary at least raised to match inflation. If you plan on long-term projects with a place, remember to negotiate for this.

Random company benefits (401K, Health Insurance, Vacations, etc etc. ).

2% stock from the ESops Pool, given over 4 years.

The specific numbers might change but such contracts are what you can expect in full-time software engineering. Following is one possible opportunity that a recruiter reached out to me with.

So why do companies utilize Golden Handcuffs? There are several reasons-

Finding and training good employees is hard. And expensive for the company. So when they meet a stud like you, they want to retain you as long as possible. Giving you incentives that accrue over time is a good way to do so.

Aligning incentives. By giving you part of the comp in stocks, you become more of a stakeholder in the compani’s success. This is why many high-level execs make most of their money in stock options.

Saves cash. Sometimes companies don’t always have a lot of cash flow, that they can use to give you a nice salary. In such cases, they might use shares to entice you to join them. You will often see this with many startups, which don’t have the resources to pay Big Tech wages.

Now you might be wondering how such an arrangement benefits you. If anything, Golden Handcuffs reduce the amount of cash a company would pay you otherwise. Very true. But…

Let’s say you decided to take a job at Google after reading about all their advancements in AI. Because Google’s AI pays off, their stock shoots up 4x in 2 years (this happens from time to time in the markets). Suddenly, the shares you have and will get are a lot more valuable. Pretty neat, huh? This is the benefit of the handcuffs. You get to share in the upside of the company.

Some considerations

When indulging with shares and the stock market, things can always be slightly dicey. I’m not going to tell you what you should and should not do. I’m not an advisor, nor do I know the nuances of your financial situation and goals. But I can tell you to think of a few different angles to make a more informed decision.

The obvious one is whether the company is public or private. As we have already discussed, shares from private companies can’t be sold on the general market. This can add a lot of hassle to your life if you want to make an exit and leave before the IPO/listing.

There is another factor that many people miss. Remember that the value of the stocks will be heavily reliant on the state of the stock market. Last week, we discussed the tech crash and mass layoffs in software development. Since then, the stock market has continued to crash. The people who signed ESOP contracts over the last few years are losing from this. The value of their stock options is much lower than it was when they signed it. This is the opposite situation to the situation described earlier.

However, such cases are mostly noise. The only real question you need to ask is whether the company has any potential to make money. Genuine potential. This might seem like a trivial task, but with all the chatter generated by the internet, it can be easy to give in to undue hype and bubbles.

If you want examples, look no further than the catastrophic fall of Tera Luna. It went from being worth 40 Billion USD to being worthless when the hype died down. Patrick Boyle has a phenomenal video explaining this. Many people lost a lot of their money trying to ride this wave.

Make no mistake, this is not an exception. WeWork is another prominent example. The company reached absurd valuations because of a combination of the tech bubble, social proof, and marketing. People would put their money because other people were putting money into the company. At no point did anyone critically evaluate, whether the company was actually a worthwhile investment. And when the house of cards came crashing down, it crashed hard.

This is the reason that I focus my newsletter on more than just pure Computer Science. Your technical knowledge is meaningless if you can’t identify good products and true value-adding solutions. This requires a base understanding of economics, finances, and the industry as a whole.

If you want to take all these skills to the next level, join our amazing list of premium subscribers. You gain access to sub-only content, discounted rates, and special consultations. These will help you develop your skills and get a huge leg up in your career. Use the button below to get a month free. Combined with our generous no questions asked, 100% Satisfaction guarantee, there is no risk to you.

If you have enjoyed this post so far, please make sure you like it (the little heart button in the email/post). I also have a special request for you.

***Special Request***

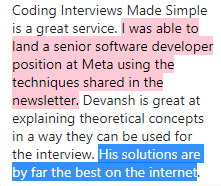

This newsletter has received a lot of love. If you haven’t already, I would really appreciate it if you could take 5 seconds to let Substack know that they should feature this publication on their pages. This will allow more people to see the newsletter.

There is a simple form in Substack that you can fill up for it. Here it is. Thank you.

https://docs.google.com/forms/d/e/1FAIpQLScs-yyToUvWUXIUuIfxz17dmZfzpNp5g7Gw7JUgzbFEhSxsvw/viewform

To get your Substack URL, follow the following steps-

Open - https://substack.com/

If you haven’t already, log in with your email.

In the top right corner, you will see your icon. Click on it. You will see the drop-down. Click on your name/profile. That will show you the link.

You will be redirected to your URL. Please put that in to the survey. Appreciate your help.

In the comments below, share what topic you want to focus on next. I’d be interested in learning and will cover them. To learn more about the newsletter, check our detailed About Page + FAQs

If you liked this post, make sure you fill out this survey. It’s anonymous and will take 2 minutes of your time. It will help me understand you better, allowing for better content.

https://forms.gle/XfTXSjnC8W2wR9qT9

Happy Prep. I’ll see you at your dream job.

Go Kill All you Financial Fiend,

Devansh <3

To make sure you get the most out of Finance Fridays, make sure you’re checking in the rest of the days as well. Leverage all the techniques I have discovered through my successful tutoring to easily succeed in your interviews and save your time and energy by joining the premium subscribers down below. Get a discount (for a whole year) using the button below

Reach out to me on:

Instagram: https://www.instagram.com/iseethings404/

Message me on Twitter: https://twitter.com/Machine01776819

My LinkedIn: https://www.linkedin.com/in/devansh-devansh-516004168/

My content:

Read my articles: https://rb.gy/zn1aiu

My YouTube: https://rb.gy/88iwdd

Get a free stock on Robinhood. No risk to you, so not using the link is losing free money: https://join.robinhood.com/fnud75