Lessons from the Crypto Bloodbath[Finance Fridays]

Social Media has been used to manipulate you. This is why a first principles analysis of the information you are given is crucial.

Hello all,

I’m sure you’ve all heard about extreme layoffs at Coinbase. Some of you know off the Tera Luna crash, where 40 Billion USD of value was wiped out. The cryptocurrency market has been in a free fall. Many people who got in trying to make a quick buck have now lost a lot of money. I will be covering some of the lessons from this event. As software devs, many of you might end up involved in this domain. This article/email will hopefully give you more to think about so that you can get into the field more informed.

Highlights

We will cover the following topics-

What caused this crash- Greed and FOMO. Many people tried to replicate the extreme rise of 2021 Dogecoin, where the price rose multiple times over. This made the market perfectly poised for pumps and dumps. Combine that with mistrust in institutions and a poor understanding of economics and we get the perfect recipe for a spectacular crash.

Why crypto is more susceptible to these swings- A big selling point of crypto is the lack of regulation and centralization in crypto. No corrupt group can influence it. However, it also makes it vulnerable to whales acting maliciously.

Why this crash is different to the “sale” in the stock market- Stock market crashes are great times to get good companies cheap. People are trying to apply the same logic to crypto. This is why the two situations are not the same.

This article might seem like I am telling you to avoid the cryptocurrency field. I’m not. I’m not a financial advisor. I just want to give you some perspective, to help you avoid the mistakes that cost many people their life savings.

What caused this crash

This is obviously a very layered question. One that could be the source of many academic dissertations. However, there are a few factors that combined to make it the perfect recipe for a spectacular crash.

Firstly is the meteoric rise of Dogecoin. In early 2021, the price of Doge shot up as mainstream people became acquainted with it.

Renewed interest spurred by Tesla CEO Elon Musk and other celebrity supporters at the start of 2021 sent doge’s price surging past its previous all-time high. The coin posted a 9,884% gain between January and May. By the end of the rally, doge had peaked at a new all-time high of $0.74.

A 10,000% increase in a couple of months is obviously an insane return. This would turn a 1000 USD investment into a 100,000 payout. In a few months. This had a lot of people thinking. If only they caught the wave at the right time, they could have been the next “Dogecoin Millionaire”.

This spawned a lot more interest in the altcoin market. We saw many coins being created with the purpose of going to the moon. Tons of investors put a lot of money into the domain, causing sharp price rises and dramatic gains. This caught more people’s attention, getting more people in, further inflating the market.

How Money Works has a phenomenal video on how social networks have an inherent bias to show you success stories. Thus people making dramatic fortunes in this domain were also promoted by the various social networks. Combine this with every influencer trying to promote their own token, and we get a lot of FOMO. FOMO causes asset bubbles. When bubbles pop, we get the crashes.

There is one final aspect, that is important for all of you to understand. That tells us why crypto and DeFi (we will cover this too, so stay tuned) are so popular. That is a growing mistrust in the organizations in power.

2020 saw extreme inflation in assets and cryptocurrencies. This is because Central Banks all over the world printed a lot of money to ease the problems caused by Covid. This had a lot of people worried about extreme inflation. This also validated the points that Satoshi Nakomoto had made all when Bitcoin was first introduced to the world. The financial system was too centralized, controlled by a few people/orgs. And these didn’t always have the best intentions.

This caused extreme price increases when times are good. However, as the economy went through trouble, and people needed to get their money out, the house of cards collapsed. And it collapsed hard.

The lack of oversight, regulation, and centralization of crypto seemed like the perfect way to opt-out of a system that could be corrupted so easily. However, this also directly to the extreme crashes that we see in crypto. Let’s cover how.

Why crypto is vulnerable to these swings and crashes

FOMO, greed, and bubbles exist wherever humans can put their money. So why do we never hear about the extreme crashes in the gluten-free cake markets?

Remember how we talked about how crypto is not regulated. This is great for freedom. However, it causes a very wild-west type of situation. To sell a “normal” product or service, you need to jump through a lot of hoops. You can’t use false/predatory marketing tactics. I can’t mislabel normal cakes as protein snacks or falsify nutritional examples.

Even in the financial markets, there are a lot of financial regulations to protect investors from false information and insider trading. As someone who actually worked with a company in the banking industry, believe me when I say that they have a lot of compliances to jump through.

Crypto has none of this. This is why we see celebrities engaged in undisclosed paid promotions, pump and dumps, and false advertising with no consequences. With normal products, this would be illegal. With crypto, there are no regulations banning this.

This means that a lot of money can flow in and out of projects with no oversight. Since the projects start off small, we get rapid increases and sharp crashes (when the people pull out). When the mania is strong, a lot of money flows in and the valuations are high. The second we see problems, the losses are just as extreme.

A lot of people are treating this as an opportunity to get crypto for cheap. A similar logic is applied to the stock market. Here is why this is a false equivalency.

Why this crash isn’t a “sale”

The wisdom in the stock market is that recessions are the best time to buy good stocks cheap. And the logic makes sense. Recessions allow you to buy good businesses at a discount price. However, the same logic doesn’t apply to crypto. Why you might ask? Let’s take a look using the sell-off of Meta as an example.

As I covered here, stock crashes are a part of the boom and bust cycle of businesses. Even as the Meta stock falls prey to the bust part, the company still made a revenue passing $100 billion and a profit of $46 billion in 2021. Regardless of the stock price, this profitability means that the company will stay afloat. Thus it makes logical sense to buy the stock cheap since you will be gaining a stake in a profitable venture at a discount.

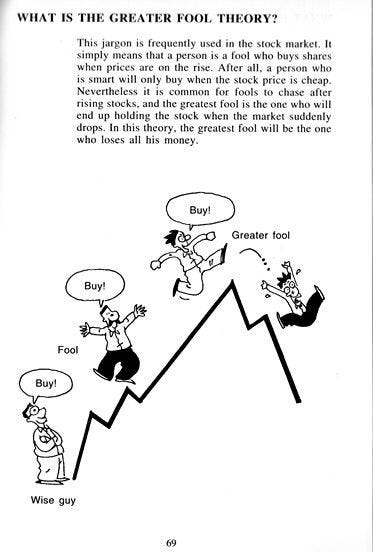

Most cryptocurrencies don’t have any plans (or even scope) for profitability and/or adoption. They are based almost exclusively on the greater fool theory, where you only make money by selling higher than your buying point.

This is not just true for smaller projects. Big projects in crypto often propose extremely high ROI. Their plan for maintaining these high yields was to print more tokens and use them to pay the holders.

In case this sounds familiar, this is exactly what the Weimar Republic and Zimbabwe did (w/ their currencies, not crypto). I’ll let you guess how that ended for them. In a delicious twist of irony, the crypto crash was fueled by the inflationary practices of many altcoins/projects, the very phenomena that Bitcoin was created to avoid.

Many people who lost their money were experienced professionals in advanced fields, including software devs. This is why I stress that developers must understand basic economics. Had people had a basic understanding of economics and/or history, they would have spotted this a mile away and avoided these projects (or gotten out early). Unfortunately, a combination of poor economics knowledge and greed prevented this.

I wish I could tell you where things will go from here. There are already calls for more regulation of crypto (the irony is not lost on me). The truth is that almost nobody can predict how the future economic systems will look. What I can say is that no matter what the systems will look like, the foundational principles will not change. Learning and mastering the basics would have helped you avoid the crash we saw currently, and they will help you avoid the manias in the future.

To those of you interested in building your foundational skills, consider getting a premium subscription to this newsletter. Thanks to our 60-day complete refund policy, you can take your time and test out this newsletter at no risk to you. Get a premium subscription and let me know if you don’t like it. I will refund your money fully. There are no downsides to you, so what’s stopping you?

If you have enjoyed this post so far, please make sure you like it (the little heart button in the email/post). I also have a special request for you.

***Special Request***

This newsletter has received a lot of love. If you haven’t already, I would really appreciate it if you could take 5 seconds to let Substack know that they should feature this publication on their pages. This will allow more people to see the newsletter.

There is a simple form in Substack that you can fill up for it. Here it is. Thank you.

https://docs.google.com/forms/d/e/1FAIpQLScs-yyToUvWUXIUuIfxz17dmZfzpNp5g7Gw7JUgzbFEhSxsvw/viewform

To get your Substack URL, follow the following steps-

Open - https://substack.com/

If you haven’t already, log in with your email.

In the top right corner, you will see your icon. Click on it. You will see the drop-down. Click on your name/profile. That will show you the link.

You will be redirected to your URL. Please put that in to the survey. Appreciate your help.

In the comments below, share what topic you want to focus on next. I’d be interested in learning and will cover them. To learn more about the newsletter, check our detailed About Page + FAQs

If you liked this post, make sure you fill out this survey. It’s anonymous and will take 2 minutes of your time. It will help me understand you better, allowing for better content.

https://forms.gle/XfTXSjnC8W2wR9qT9

Happy Prep. I’ll see you at your dream job.

Go Kill All you Financial Fiend,

Devansh <3

To make sure you get the most out of Finance Fridays, make sure you’re checking in the rest of the days as well. Leverage all the techniques I have discovered through my successful tutoring to easily succeed in your interviews and save your time and energy by joining the premium subscribers down below. Get a discount (for a whole year) using the button below

Reach out to me on:

Instagram: https://www.instagram.com/iseethings404/

Message me on Twitter: https://twitter.com/Machine01776819

My LinkedIn: https://www.linkedin.com/in/devansh-devansh-516004168/

My content:

Read my articles: https://rb.gy/zn1aiu

My YouTube: https://rb.gy/88iwdd

Get a free stock on Robinhood. No risk to you, so not using the link is losing free money: https://join.robinhood.com/fnud75