Personal Finance for Tech 101 [Finance Fridays]

How Software Engineers, Managers, and Tech Leaders can set up to survive the worst recessions

To learn more about the newsletter, check our detailed About Page + FAQs

To help me understand you better, please fill out this anonymous, 2-min survey. If you liked this post, make sure you hit the heart icon in this email.

Recommend this publication to Substack over here

Take the next step by subscribing here

This is a follow-up to my write-up on the Boom and Bust Cycle for Tech and why it causes such vicious layoffs. This article will be dedicated to the personal finance section, going over how you can set yourself up to prevent these problems. To understand what causes these crashes in the first place, check out the following article covering the Boom and Bust Cycle in business.

By the end of this article, you should have a good foundation on how you can set up to survive any recessions going forward.

Important Points

Have an Emergency Fund- The first thing you should have is an emergency fund that will help you if you get laid off. This should be 6-12 months (depending on your risk tolerance) of your operating expenses. In other words, you should have 6-12 months of expenses saved up. This way you will be able to survive the recession without selling off your investments during a market downturn(which must be avoided at all costs, barring true emergencies).

Pay off high-interest debt- “A penny saved is a penny earned.” Remember Debt takes money out of your pocket. People get too over-zealous about investing and forget to pay off their debts early. Over the long-run, debt will take a lot more money than your investments bring in.

50-30-20- Once you have your emergency fund, this next guideline can be very helpful. For every 100 dollars you make, use 50 for expenses, invest 30, and save 20 for emergencies. Once you have a lot saved up (judge based on your needs), you can start investing that portion (or use that to live your life if that’s what floats your boat). Remember, if you have high-interest debt, paying it off is one of the best investments you can make.

Investing your money- This is something you have to figure out for yourself, based on your interests and expertise. I invest more in Tech and AI stocks since that is a field that I understand (and I’ve even been offered a lot of money to do it). Some people like real estate. It depends on you and your situation. It would be irresponsible for me to say “Invest in X” without knowing your circumstances. That being said, there are a few basic ideas that will work for most people. Let’s cover 3 that will generally work for everyone.

Investing in yourself- First are investments in yourself. This can be education in the form of a new degree, courses, mentorship, books, or even a premium subscription to this newsletter. Anything that helps you make more money. Exposing yourself to new experiences through travel, new hobbies, and meetups can be great for you personally and professionally. Investing in your health, both mental and physical, will always pay off. Or you can create a new business/venture, which is risky but has unlimited upside if it works out. Investments in yourself can pay off in spades, often in unexpected ways. For example, people read my articles on AI research/this newsletter and reach out to me with roles. I’ve talked about how I’ve been offered referrals in top companies through people I meet in BJJ/MMA. Investing in yourself is always one of the best things you can do for yourself.

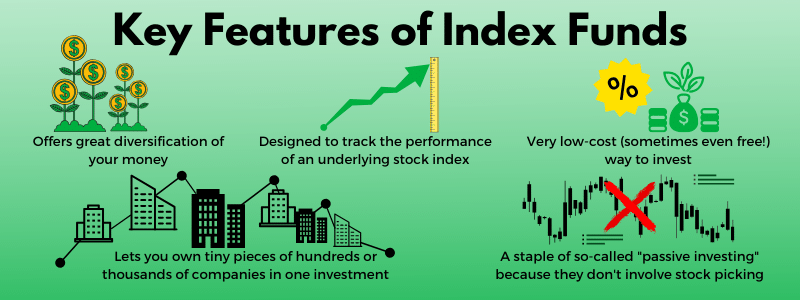

Investing in low-cost index funds- Passively managed index funds are bags of investments into companies done by algorithms. These algorithms invest based on simple rules. These funds have low costs, provide great diversification, and don’t require much effort on your side. These make it great for people looking to invest their money in the market without spending all day glued to their screens. You can simply buy these funds and not worry too much. An example of this is the S&P500 in America. Look at the equivalent in your country.

Investing into your community/network- We’re social creatures. Investing in your community is one of the best things you can do, even from a selfish perspective. Investing in community projects, social ventures, and public initiatives is a great way to improve your (and everyone’s) quality of life, meet lots of people (aka networking), and see the changes you want. Not to mention the tax benefits and social credit, that normally come with these investments.

Use these tips to build a strong fortress that will keep you strong when the recessions come knocking.

I created Technology Made Simple using new techniques discovered through tutoring multiple people in top tech firms. The newsletter is designed to help you succeed, saving you from hours wasted on the Leetcode grind and self study. I have a 100% satisfaction policy, so you can try it out at no risk to you. You can read the FAQs and find out more here. You can scroll below to get 20% off for upto a whole year.

If you have enjoyed this post so far, please make sure you like it (the little heart button in the email/post). I also have a special request for you.

***Special Request***

This newsletter has received a lot of love. If you haven’t already, I would really appreciate it if you could take 5 seconds to let Substack know that they should feature this publication on their pages. This will allow more people to see the newsletter.

There is a simple form in Substack that you can fill up for it. Here it is. Thank you.

https://docs.google.com/forms/d/e/1FAIpQLScs-yyToUvWUXIUuIfxz17dmZfzpNp5g7Gw7JUgzbFEhSxsvw/viewform

To get your Substack URL, follow the following steps-

Open - https://substack.com/

If you haven’t already, log in with your email.

In the top right corner, you will see your icon. Click on it. You will see the drop-down. Click on your name/profile. That will show you the link.

You will be redirected to your URL. Please put that in to the survey. Appreciate your help.

In the comments below, share what topic you want to focus on next. I’d be interested in learning and will cover them. To learn more about the newsletter, check our detailed About Page + FAQs

If you liked this post, make sure you fill out this survey. It’s anonymous and will take 2 minutes of your time. It will help me understand you better, allowing for better content.

https://forms.gle/XfTXSjnC8W2wR9qT9

I’ll see you living the dream.

Go kill all and Stay Woke,

Devansh <3

To make sure you get the most out of Finance Fridays, make sure you’re checking in the rest of the days as well. Leverage all the techniques I have discovered through my successful tutoring to easily succeed in your interviews and save your time and energy by joining the premium subscribers down below. Get a discount (for a whole year) using the button below

Reach out to me on:

Instagram: https://www.instagram.com/iseethings404/

Message me on Twitter: https://twitter.com/Machine01776819

My LinkedIn: https://www.linkedin.com/in/devansh-devansh-516004168/

My content:

Read my articles: https://rb.gy/zn1aiu

My YouTube: https://rb.gy/88iwdd

Get a free stock on Robinhood. No risk to you, so not using the link is losing free money: https://join.robinhood.com/fnud75