Why Tech and Crypto Stocks are so extreme [Finance Fridays]

This is something that a lot of you have asked.

To learn more about the newsletter, check our detailed About Page + FAQs

To help me understand you better, please fill out this anonymous, 2-min survey. If you liked this post, make sure you hit the heart icon in this email.

Happy Friday my amazing readers,

First off, some of you will be wondering why you’re here. You signed up in the Google Form I left in this article I wrote, honoring my grandma. Enjoy your complimentary 1-year subscription. And remember to remember the name Veerbala Sudan, an educator that touched many lives.

A lot of you really loved my insight into the tech crash. However, some of my more critical viewers reached out with a very interesting question:

Why is the tech crash so dramatic? There is a global recession happening now, but you don’t hear much about Pancake Companies being wiped out. Why are so many companies in the Tech and Crypto getting wiped out? Especially when they were worth so much.

That sounded like a great topic to cover, especially as the Crypto Trading firms have been going belly up these past few weeks (like Voyager which we covered here). All in all, we’ve seen over 100 Billion USD wiped out in just crypto. That number goes through the roof when we also consider all the value lost in as tech firms go bye-bye.

How can the same kinds of companies that return 1000% in 5 months also crash so quickly?

Take a second to think about it. If you have any thoughts/theories leave them in the comments/reply to this email. All conspiracy theories welcome. I’m now going to break it down.

Summary

We’re going to cover the following ideas

Blitzscaling inflates things- Blitzscaling is the act of growing very very rapidly, without concern for immediate profitability. The idea is that having a large user base can eventually be translated to money later. Most big tech used this approach to grow. This approach leads to very high valuations, even when the companies aren’t making money.

People have no idea how to make money- Many tech companies grow large for the sake of it, without any clear path to profitability. When the economy is hot, they get more VC funding. When things are bad, they implode since they were never sustainable.

This is why as a developer, we need the knowledge to pick between economically viable companies and products from bad ones. Because when these companies implode, we’re the ones suffering. Look no further than the mass layoffs in the field.

Why Tech is uniquely suited to this extreme boom and bust- Tech operates at scale. We covered this here. The smallest change in either direction is magnified. This is why tech can both make hundreds of billions and lose that amount within 2 years. However, there is another point that is overlooked.

Tech investing is a game of hot potato- Why do VCs fund bad companies? To get an exit, at the cost of someone else. Often the ones that suffer in the end are normal investors like you and me. This is one of the reasons that Finance Fridays are a thing. Learn about these ideas, to make sure no one takes advantage of you.

How Blitzscaling messes with the world

Imagine we were both running competing shops selling Garlic Milkshakes. Our quality is similar. You’re a good student, the one that will create a solid product, get a few customers, and grow steadily- making a profit the whole time. Your business will be steady, and you will eventually reach 100,000 monthly customers after 10 years of growth. You’re now raking in a profit of 1 Million USD per month. Sounds great!! This is the typical way business was done.

I, on the other hand, am woke. Not just woke, I am the most woke person to ever sell milkshakes. So I hit up my Wall Street Bros and ask them for a huge loan. With that loan, I run a very aggressive campaign and give insane discounts to get people in my door. I’m not making a profit, but I don’t care. I can tell my Wall Street Bros that my business is doubling every 15 days, and get more investment from them. I will reach that 100,000 monthly customer mark in just 1 year. But I will be making a loss of 1 Million USD/month. This is blitzscaling, the prevailing model adapted by most crypto and tech firms.

Why would anybody do this? Easy. Imagine you and I were competing. Because I am burning someone else’s money, I can run much longer at a loss. I would very quickly drive you out of business (unless you also got investors). And once I am the king of the Garlic Milkshake market, I can raise prices all I want. I have a monopoly. I can now focus on making money (and stifling the competition). This is the power of the Network Effect- a phenomenon whereby a product or service gains additional value as more people use it.

This was the prevailing model adopted by all the big tech companies you see now. Venture Capital is based on funding these companies while they were unprofitable so that when they blow up the VCs can make it big. Remember kids, high risks—>high returns.

There is nothing inherently wrong with this. It is only natural for businesses to struggle early and require early investment. I had to develop my ML skills for 4 years before I got my first 100 USD per hour offer. I wrote for 5 months before I got my first paying sub here. In a way, I was running at a loss at this time, requiring outside investment.

So why does this cause so many problems? Often, blitzscaling is applied to products chasing vanity numbers instead of real sustainability. Let’s break that down.

Chasing the wrong numbers

Let’s go back to our milkshake situation. Notice that there was a clear answer to how I would eventually make money. I wasn’t going to burn VC money to subsidize garlic milkshakes forever.

Now imagine if instead of premium garlic milkshakes, I was making trash ones. Nobody would be willing to pay for them. No matter how many customers I get, I would never have a path to profitability. The second I raise prices, customers leave. And my profits become the same as the number of Major Trophies won by Tottenham Hotspurs (0).

A lot of VC money goes into funding such companies (I often mention WeWork as an example of overfunded garbage on this newsletter). Why does this happen? There are many reasons for this.

One is simply ignorance. As a business owner, it can be exciting to see consumers flooding my doors. When I report my insane growth, investors start getting hot and bothered, and fund more money. Seeing this, more people throw money. This creates investor FOMO, driving the valuations of my business higher. A bubble is created(I covered this idea more in my piece on the Crypto Crash mentioned earlier). In essence, my business is incentivized to gain more customers, not to actually make money.

This happens because no VC is actually stopping to check whether my milkshake is any good. They are simply blinded by the customer growth. I am also not checking whether my milkshake would sell on its own since I assume the growth is a proxy for quality.

When times are good, and there’s extra money floating around, VCs will be able to fund my growth. The miracle growth will continue, and everyone will look like a genius. The problem happens when the market invariably cools down (the Boom and Bust cycle is a part of our economy). Then suddenly, there’s a little bit less money. My deals get less lucrative. Customers leave the store in droves. This causes a spiral, as this leaves me with less money. My business crash is as dramatic as my growth was.

Take a second to think about This can happen to any industry. Why is this problem so much more common to tech?

Why Tech is well-suited for this system

We already covered how tech solutions are uniquely suited to benefit from both economies of scale and the network effect. This is one of the reasons that VCs are willing to throw money at tech solutions to acquire most users. As I’ve reiterated, most big tech companies were at one point in time very unprofitable. Now they’re money makers.

This has made investors more willing to burn their money on tech companies to let them acquire customers. This is why blitzscaling has become the defacto model for Silicon Valley companies (and tech worldwide). However, there is another factor that is often overlooked.

Imagine how complex tech is. I know nothing about Front-end development, Microchip design, and much more. And I work in the industry. This can make analyzing whether a product is viable very hard, especially when requires multiple specialties. VCs don’t have the expertise to go through the tech specs to pick good products.

And most engineers won’t take the time to think of a business strategy and whether a company/product is reasonable. They want to leave it to their product managers and finance department. They won’t even bother studying basic economic theory to evaluate potential firms to work at. The scores of amazing engineers being laid off from Coinbase and other unsustainable firms (many of whom didn’t even start their first day before being fired) serve as enough of a cautionary tale.

However, if you did study the basics, you will reap the benefits. As I’ve demonstrated many different times in this newsletter, stacking multiple skills on top of each other will rocket your earning potential. Pick one domain to master, and master the basics of the other important fields, and you will do very very well.

Ignorance can however be fixed. There is a lot of money being thrown around, so why don’t the VCs invest a little bit into either developing their skills or having experts vet the investments. Why put money into potentially terrible companies. This is where things take a slightly sinister turn, and this is the reason everyone needs a basic amount of financial education.

Tech investing and Hot Potatoes.

To those not familiar with the game, Hot Potato has a simple premise. A ball/object is passed around a group for a random amount of time (as music is playing). When the music stops, whoever has the ball loses. What does this have to do with anything?

VC firms and investors play a very similar game. When they invest in a startup, they do with the hopes of gaining an exit at a later point in time. They don’t really care if the product they are investing in will stick around long term. They just want to sell their investments at a higher price than what they bought. If the product is garbage, they just need to make sure they aren’t the last ones holding it.

So why do you care about VCs screwing each other over, passing around hot garbage? Some will win and others will lose, but what does this have to do with you. Most of you aren’t accredited investors, who can invest in private companies either way.

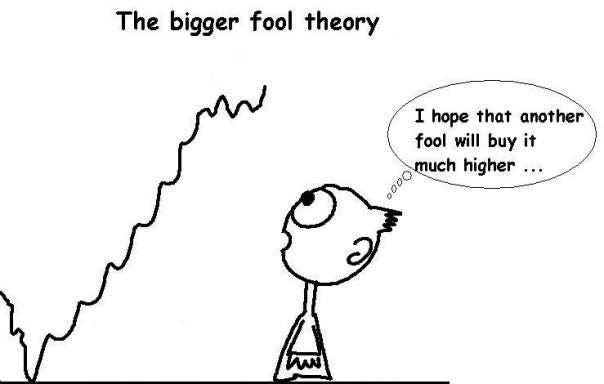

Well you see, this doesn’t end at private equity. Often these companies will make it out to the public markets. Here, the hot potato is passed to ordinary investors, people like you and me. The worst part is that, unlike the VCs, we don’t have the resources to separate fact from fiction, to filter out the hype. Unsuspecting retail investors will put in money into a company with amazing growth and tons of investors, not realizing they are the bigger fool. Thus, you’re left holding the hot potato.

This is why I’ve spent so many Fridays discussing the crypto crash. Because when Celcius, Voyager, and Luna crash; it’s not Matt Damon, Jake Paul, these crypto influencers, or Wall Street that lose money, it’s normal people who were gullible enough to fall for the predatory marketing and manufactured hype.

So what can be done about this?

The Closing

Believe it or not, I’m not asking you to burn down the system or start screaming about how everything sucks. This same system has led to some amazing products, that have made all our lives much better. The problem is people taking advantage of the ignorance of everyday folk to make money.

The best way to fix this is by educating yourself. Start by sharing this with 5 people who might benefit from learning about this. Make sure you understand these concepts and ideas well. Read into the ideas and resources I share. And develop a foundation of your skills, not just your engineering. If you’re looking for one place to level up your understanding of Theoretical Computer Science, Software Engineering, and the economics of the Tech industry, then you’re at the right place.

I created Coding Interviews Made Simple using new techniques discovered through tutoring multiple people into top tech firms. The newsletter is designed to help you succeed, saving you from hours wasted on the Leetcode grind. I have a 100% satisfaction policy, so you can try it out at no risk to you. You can read the FAQs and find out more here. You can scroll below to get 20% off for upto a whole year.

If you have enjoyed this post so far, please make sure you like it (the little heart button in the email/post). I also have a special request for you.

***Special Request***

This newsletter has received a lot of love. If you haven’t already, I would really appreciate it if you could take 5 seconds to let Substack know that they should feature this publication on their pages. This will allow more people to see the newsletter.

There is a simple form in Substack that you can fill up for it. Here it is. Thank you.

https://docs.google.com/forms/d/e/1FAIpQLScs-yyToUvWUXIUuIfxz17dmZfzpNp5g7Gw7JUgzbFEhSxsvw/viewform

To get your Substack URL, follow the following steps-

Open - https://substack.com/

If you haven’t already, log in with your email.

In the top right corner, you will see your icon. Click on it. You will see the drop-down. Click on your name/profile. That will show you the link.

You will be redirected to your URL. Please put that in to the survey. Appreciate your help.

In the comments below, share what topic you want to focus on next. I’d be interested in learning and will cover them. To learn more about the newsletter, check our detailed About Page + FAQs

If you liked this post, make sure you fill out this survey. It’s anonymous and will take 2 minutes of your time. It will help me understand you better, allowing for better content.

https://forms.gle/XfTXSjnC8W2wR9qT9

I’ll see you living the dream.

Go kill all and Stay Woke,

Devansh <3

To make sure you get the most out of Finance Fridays, make sure you’re checking in the rest of the days as well. Leverage all the techniques I have discovered through my successful tutoring to easily succeed in your interviews and save your time and energy by joining the premium subscribers down below. Get a discount (for a whole year) using the button below

Reach out to me on:

Instagram: https://www.instagram.com/iseethings404/

Message me on Twitter: https://twitter.com/Machine01776819

My LinkedIn: https://www.linkedin.com/in/devansh-devansh-516004168/

My content:

Read my articles: https://rb.gy/zn1aiu

My YouTube: https://rb.gy/88iwdd

Get a free stock on Robinhood. No risk to you, so not using the link is losing free money: https://join.robinhood.com/fnud75

Can you share how and where you learnt these skills ?

Dredd Pirate shall be coming Up shortly, answer HTF did IRS Auditors break an unbearable Bitcoin, yet at the same time the Biden Family need directions To Pee! Yea Allowed this to continue on 20 years later! At Obama’s Preas Conference Vowing to never Allow Bitcoin back to Life. who gave the Unlawful order to look the Other Way! Assange been Waiting for more than 2 years, has the Evidence of Everything can’t imagine why not! Americans always Come Last! At DHS, recieved the Training & Became a CISSP & CEH!