Is Evergrande's Liquidation China's Lehmann Brother's Moment [Finance Fridays]

The similarity has a lot of people panicking (and proclaiming the end of China)-

Hey, it’s your favorite cult leader here

On Fridays, you get posts about money 💲💰💰💲. Expect a mix of posts on personal finance, breakdowns of the most relevant events in the Tech Industry, and insights into the funky workings in the financial markets. 🔍🔍. Use these posts to master the money game, and solidify your finances to ride out the meanest of recessions.

To get access to all the articles, support my crippling chocolate milk addiction, and become a premium member of this cult, use the button below-

p.s. you can learn more about the paid plan here.

To answer the question in the title- probably not. It’s not going to be as bad. So relax. Many fearmongers are calling for the end of China, but that’s not likely (the situation is still bad, but not as bad as some people paint it out to be). Onwards with the rest of the piece.

A Hong Kong court has officially ordered for the liquidation for the Chinese Real-Estate giant Evergrande. Given the overlaps with the 2008 crisis, global supply chain reliance on China, and the other socio-economic problems, this has some people concerned about the possibility of another global economic crisis. This problem is made worse by clickbait-merchants, who have used this opportunity to even herald the collapse of China.

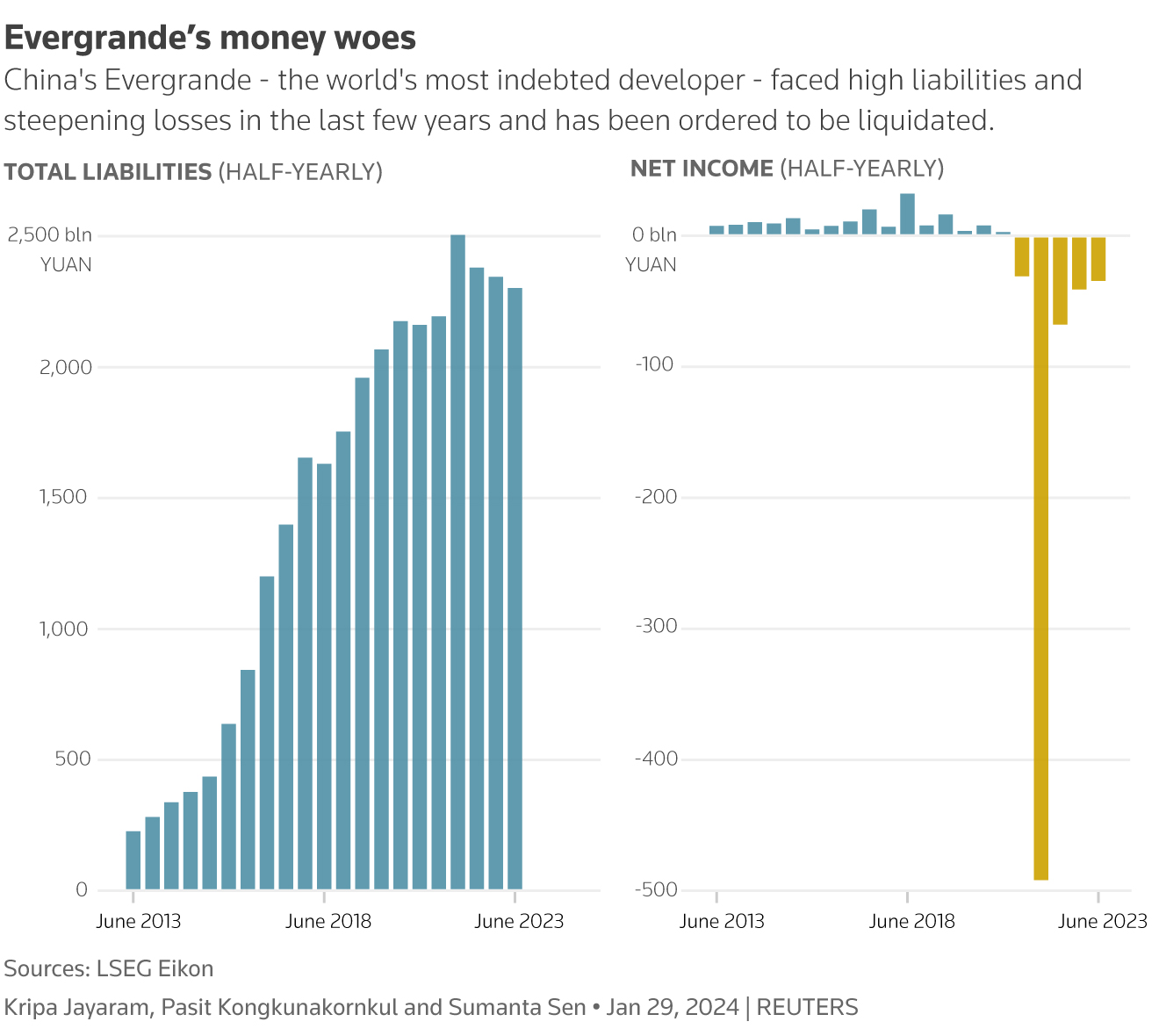

The firm is the world's most indebted property developer, with $300 billion in liabilities.

-2024 is already shaping up to be such a fun year

In this piece, we will look at the situation, how it happened, how it’s likely to develop, and why the tech industry in particular should pay attention to it. The worst thing that we can do in a situation like this is to overeact and panic. Hopefully, this work helps you understand the situation better, take a step back, and chill tf out.

Key Highlights

Evergrande's Debt Crisis

Background: Evergrande is a major Chinese property developer that has been struggling with a massive amount of debt for several years. A few years ago, the Chinese government introduced new regulations to curb debt in the real estate sector, which put further pressure on Evergrande and curbed their ability to raise new capital. This is what killed them.

Evergrande’s Asset Concerns- Much of EGs assets were tied into incomplete projects. Thye were using presales and debt to expand their operations quickly. This ‘growth before sustainibility‘ approach is very common in Tech, and more people need to be aware of the risks that come with using high amounts of leverage to grow/maintain a business (we covered Blitzscaling in this deep dive into why Billion Dollar Companies go bankrupt overnight).

Default + Liquidation: A while ago, Evergrande defaulted on its debt, triggering fears of a financial crisis (it wasn’t the only one). However, crisis was averted.

Now we have the liquidation court order, which means that the company's assets will be sold off to pay back its creditors. However, given the massive discrepancy b/w the assets and liabilities, many people are likely to go unpaid.

Impact on China's Economy

Real estate: The collapse of Evergrande is likely to have a significant impact on China's economy, as real estate is a major sector and a key investment for households. The construction slowdown could lead to job losses and economic instability. This might end up being a good thing for China, since Real Estate is notoriously overpriced due to false expectations of the invincibility of Real Estate. This might be bitter medicine, calming the market down.

Financial system: The crisis could also expose weaknesses in China's financial system, and it’s quirks. Since these companies are state-backed enterprises, they take the ‘too big too fail’ very seriously, behaving in very risky ways. To quote this excellent overview of the situation, “Borrowing for large Chinese companies like Evergrande had never been a problem in the past. It was widely assumed they would never be allowed to default on their obligations. Local governments and regulators were expected always to step in at the last minute to restructure liabilities and recapitalize the borrower if necessary. As a result, there was very little credit differentiation in the lending markets. Banks, insurance companies, and bond funds fell over each other to lend to large, systemically important borrowers. Moral hazard, in other words, underpinned the entire credit market.”

Consumer + Investor confidence: The uncertainty surrounding the real estate sector could also dampen consumer confidence and spending. More worringly, this might discourage public participation in the stock markets, both domestically and from abroad (foreign investors have also been burned by investing into Chinese companies before). Foreign Investment is one thing, but a lack of domestic participation in the markets can worsen wealth inequality. Skepticm around then markets and investing was already teetering. Take a look at this A hilarious joke shared by my collaegue Yiru. It reflects the cynicism that many Chinese people have engaging with the financial system.

And the famous jokes for home buyers - "the bad news is your house is gone, but the good news is your debt is still there"

I hope the government is able to repair the sentiment by providing safe, stable, and affordable investments to the people.

Global Impact

Not 2008: The collapse of Evergrande is unlikely to be as bad as 2008 (for some odd reason, this has been popping up in different conversations over the past week), as China's real estate market is not as integrated into the global financial system as the US market was in 2008. Furthrmore, the system is not as messy as the selling of junk mortage-backed securities +derivatives, which 10xd the impact zone of the real estate crash.

Commodity prices: The real estate slow down could lead to lower demand for commodities such as iron ore and copper, which would hurt resource-exporting countries. This might not be as bad, especially if the government steps in by funding large scale infra investments to counter the crash.

Chinese Government's Response

Stimulus: The Chinese government is likely to take steps to stimulate the economy and support the real estate sector. This could include measures such as tax cuts, infrastructure spending, and looser monetary policy. China has been notably interventionist, investing in large public infra projects during the Covid shutdowns and even offering cows to poor farmers-

Beijing has deposited nearly $ 700 billion in loans and grants for poverty alleviation over the past five years – about 1 percent of each year’s economic output. That excludes large donations from state-owned companies such as State Grid, a giant energy transmission that has invested $ 120 billion in upgrading rural electricity and allocated more than 7,000 workers to poverty reduction projects.

Beijing has reacted quickly, to this liquidation announcement-

Investments into large scale infra, should also help temporarily placate the youth, many of whom have been engaged with ‘bai-lan’ and ‘tang-ping’, although long-term solutions to their grievances requires systemic changes (such as fixing the 9-9-6 culture).

Financial stability: This whole event was triggered by China’s fight against rising debt levels. This crisis is tricky because if the government injects liquidity to fight it, it will increase debt. If not, the collapse will hurt many. Either way, this will be a good reminder why we need transparency and quality control in our financial systems

Relevance to Tech/Industry

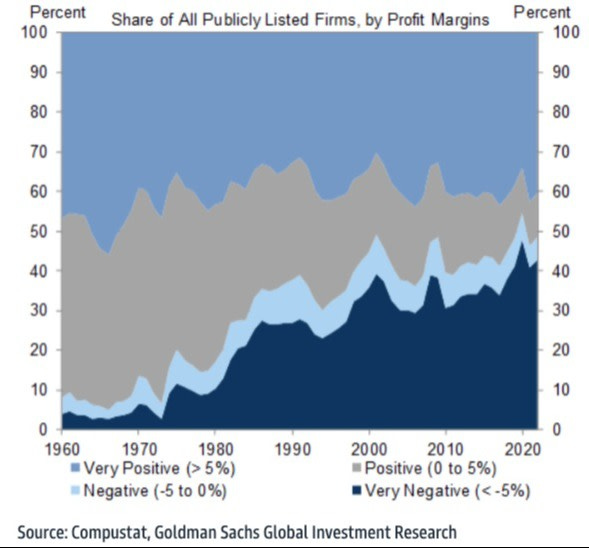

Here’s a fun stat for you. Half of all publicly traded companies in America are not unprofitable. Many of these are ‘tech companies’, hoping to reach the jannat of economies of scale, high profit margins, and the network effect. Their operations are funded by cheap VC money and heaps of Debt. Companies that highlight their growth often forget to mention this little caveat. Don’t let yourself be taken by deceptive marketing, and half true headlines. I’m not telling you not to engage with some organizations, but just beware of the dangers when you do.

I hope this provides a more in-depth overview of the situation. There can be a lot of noise surrounding these situations, but it’s best to take things easy. If you’re looking for more information on this topic, I would recommend watching the excellent analyst Plain Bagel. He has 4 videos on this topic, where he calmy dissects the matter without getting idealogical. I’m linking the most recent one here, but you can find the others in the video description.

That is it for this piece. I appreciate your time. As always, if you’re interested in working with me or checking out my other work, my links will be at the end of this email/post. If you like my writing, I would really appreciate an anonymous testimonial. You can drop it here. And if you found value in this write-up, I would appreciate you sharing it with more people. It is word-of-mouth referrals like yours that help me grow.

Save the time, energy, and money you would burn by going through all those videos, courses, products, and ‘coaches’ and easily find all your needs met in one place at ‘Tech Made Simple’! Stay ahead of the curve in AI, software engineering, and the tech industry with expert insights, tips, and resources. 20% off for new subscribers by clicking this link. Subscribe now and simplify your tech journey!

Using this discount will drop the prices-

800 INR (10 USD) → 640 INR (8 USD) per Month

8000 INR (100 USD) → 6400INR (80 USD) per year (533 INR /month)

Reach out to me

Use the links below to check out my other content, learn more about tutoring, reach out to me about projects, or just to say hi.

Small Snippets about Tech, AI and Machine Learning over here

AI Newsletter- https://artificialintelligencemadesimple.substack.com/

My grandma’s favorite Tech Newsletter- https://codinginterviewsmadesimple.substack.com/

Check out my other articles on Medium. : https://rb.gy/zn1aiu

My YouTube: https://rb.gy/88iwdd

Reach out to me on LinkedIn. Let’s connect: https://rb.gy/m5ok2y

My Instagram: https://rb.gy/gmvuy9

My Twitter: https://twitter.com/Machine01776819

Excellent take here, Dev: catastrophic for China, but not anything like 2008 for the rest of the world.

I feel the impact of the Liquidation is underreported and underestimated, I just hope china doesn’t run into crises